how are rsus taxed when sold

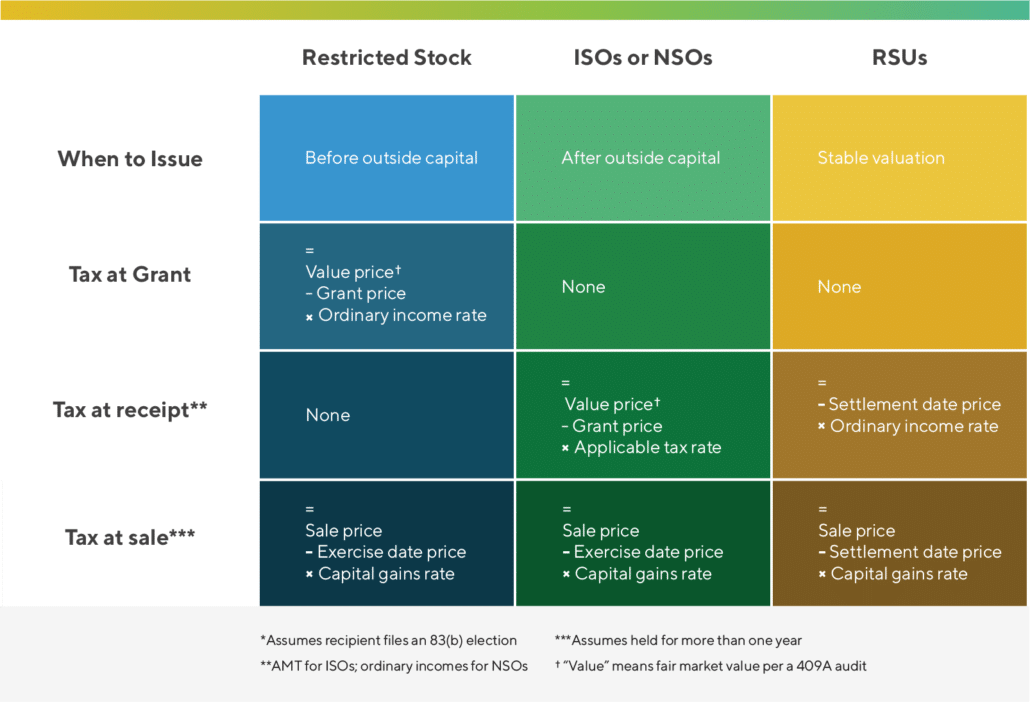

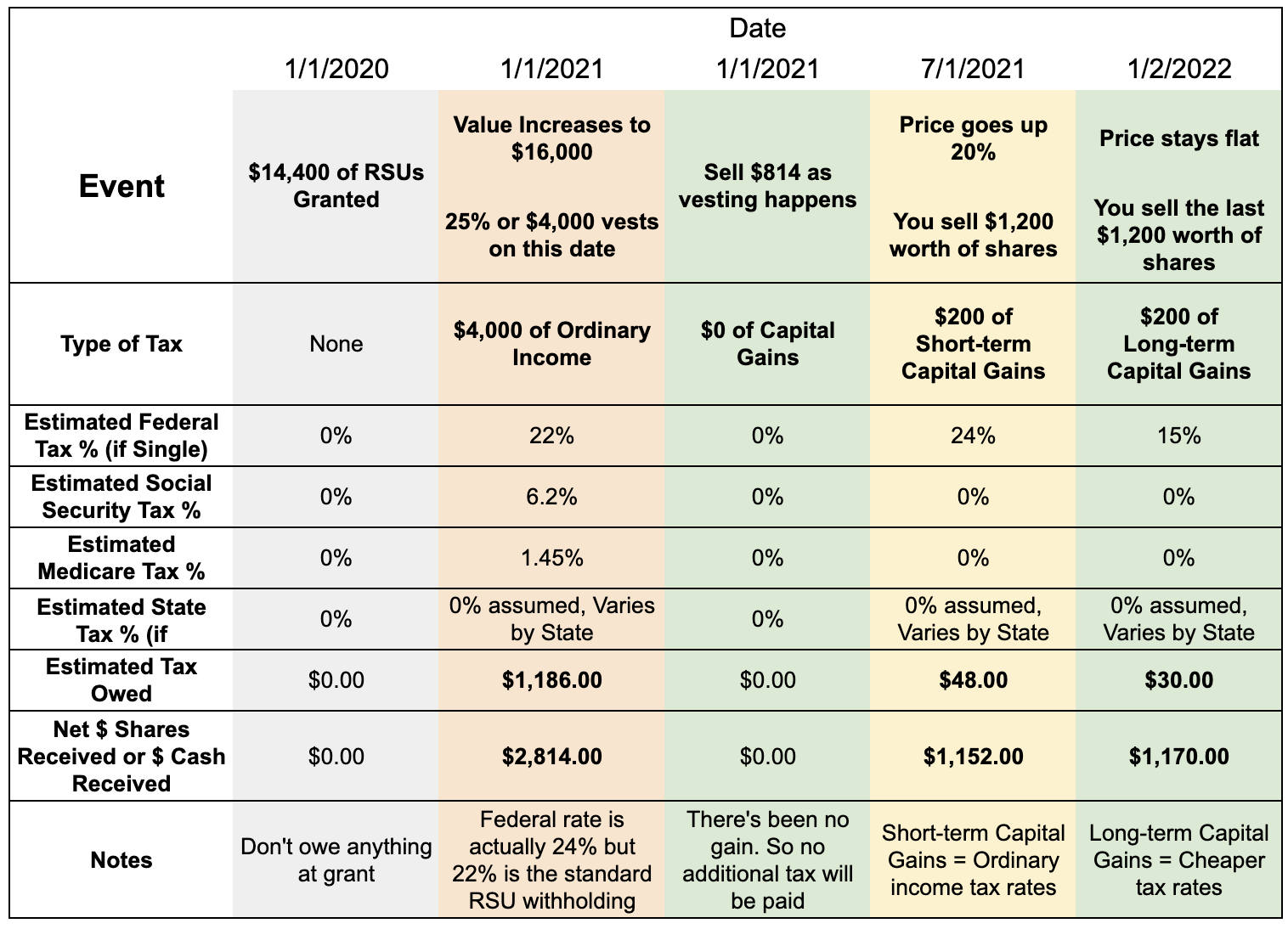

Just as with a cash bonus RSUs are taxed as ordinary income. Sales price price at vesting x of shares Capital gain or loss Get Help With Your Taxes Tax Liability of RSUs.

Should I Sell My Rsus Restricted Stock Units Thinking Big Financial

The chart above shows that the employee sold some of the shares each year to pay taxes.

. Because the RSUs pushes your total income above 100000 you will pay 60 income tax on the RSUs. How are RSUs taxed. Also restricted stock units are subject.

This is known as the 60 tax trap. 44 020 7309 3851. For every 2 you earn above 100000 your Personal.

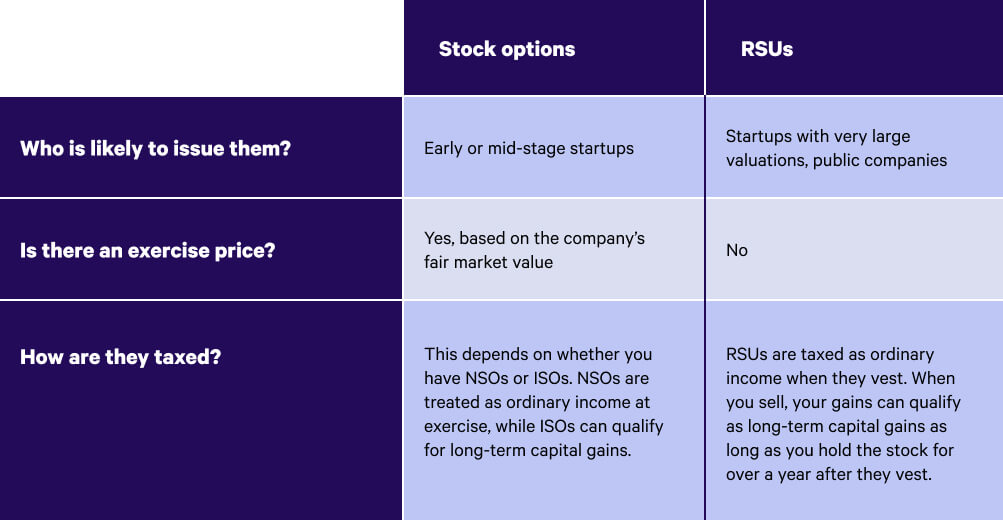

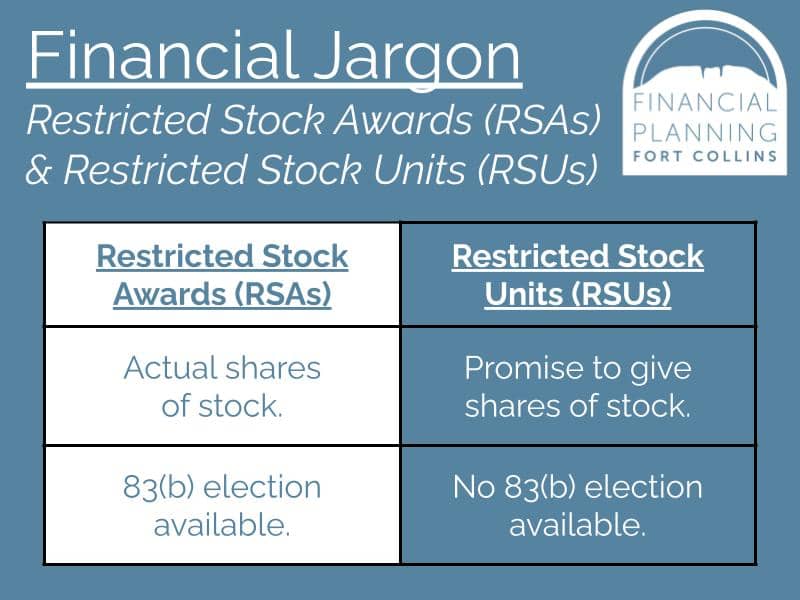

At the time that these RSUs are received by the taxpayer part of them are actually sold to offset the tax withholdings and some tax withholdings are paid using the proceeds. RSU taxation is something to consider when you are deciding whether or not to sell. For one a recipient cannot sell or.

It is the difference between the price you purchased the RSU the vesting price. If you received a 1099-B you have to report the sale. When they vest and when theyre sold.

RSUs are taxed at the time when your stocks are vested or released to you by your employer thats why you see such Eg. The amount will be based on. The stock is restricted because it is subject to certain conditions.

If you hold on to your RSU stock and the stock gives you dividends then youll have to pay. Well continue the assumption that you dont. Regardless if you sell or hold the RSU you will be taxed on the full value of the shares held.

March 17 2020 936 AM. FMV of Stock. Upon vesting the amount is considered as ordinary income.

The grant date itself is not a taxable event. I want to sell some stock shares RSUs to diversify my assets and harvest a loss for tax purposes. They are taxable when it is delivered after they are vested.

RSUs are generally taxed at two points in time. Im hoping you folks can help me navigate this to avoid a wash sale. RSU tax at vesting date is.

RSUs are taxed when they vest. Federal Income Tax - Varies based on income Social Security Tax - 62 up to. Here are the different ways you can be taxed.

The four taxes youll owe when you receive a paycheck or when an RSU vests include. Restricted stock is a stock typically given to an executive of a company. If we assume that the value will be settled in shares after a 22 statutory withholding well assume there are no other taxes withheld to.

Tax when shares are sold if held beyond vesting date is. Income is reported on the W-2 and shares are withheld to. Generally tax at vesting for RSU.

If you sell the stock at a higher price than its fair value at the time of vesting youll have a capital gain If you hold the stock for one. It is taxed on the value of the shares. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

How are RSUs taxed. If held beyond the vesting date the RSU tax when shares. Taxes When You Sell RSUs There is a separate capital gains tax that youll owe when you actually sell the stock award too assuming you sell at a gain.

Partner Tax t. RSUs can trigger capital gains tax but only if the. Realtor com spearfish sd.

The of shares vesting x price of shares Income taxed in the current year. Restricted Stock Units better known as RSUs are an increasingly popular form of incentivisation offered to employees. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

Stock Options And Other Equity Compensation Strategies Founders Circle

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Should I Sell My Rsus Restricted Stock Units Thinking Big Financial

:max_bytes(150000):strip_icc()/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

Rsa Vs Rsu Everything You Need To Know Global Shares

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic Tax

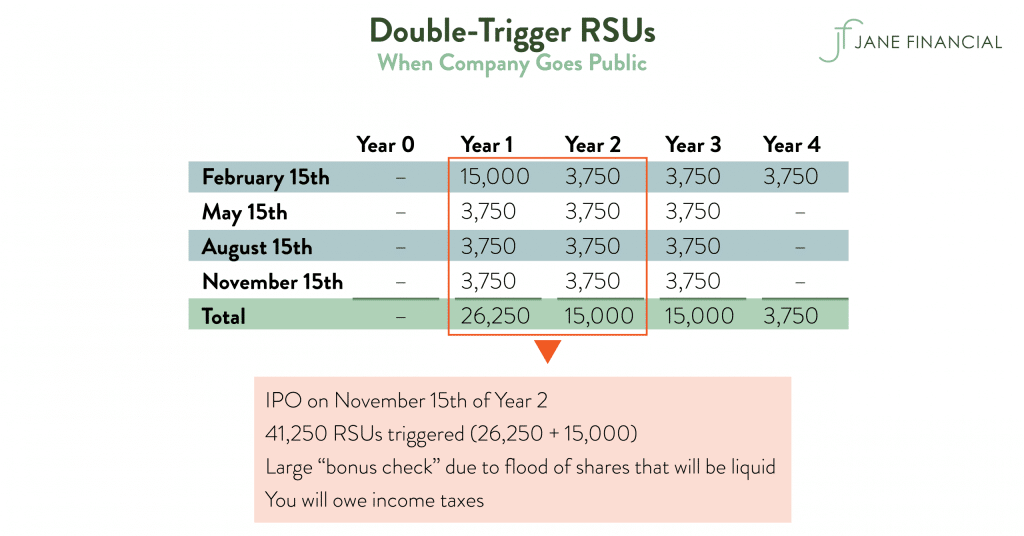

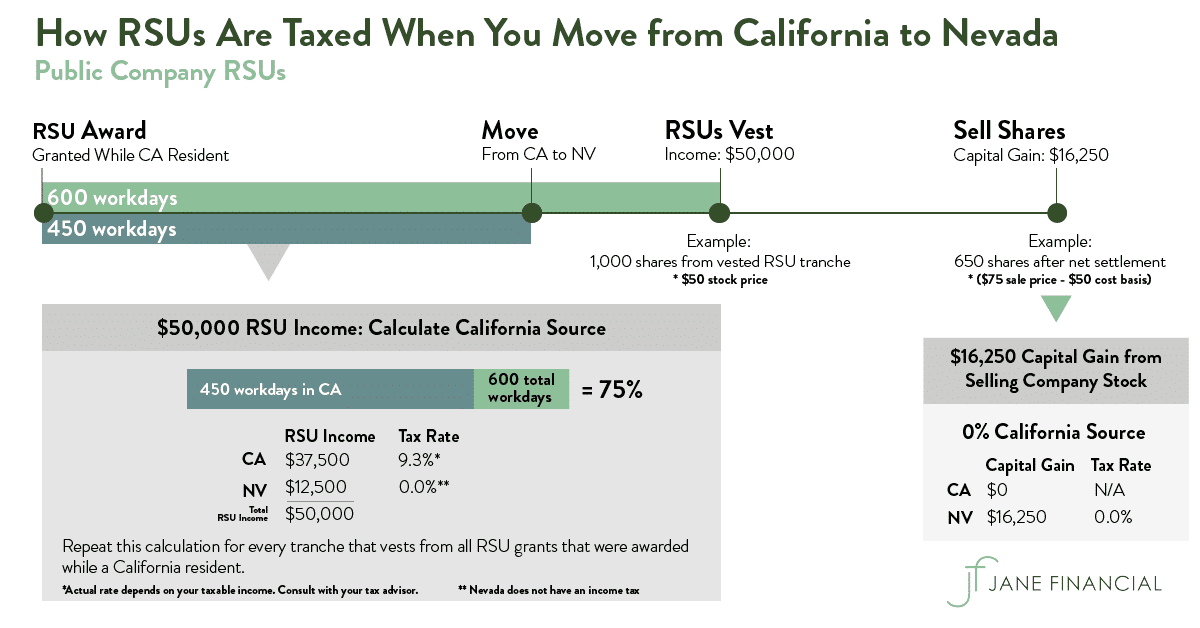

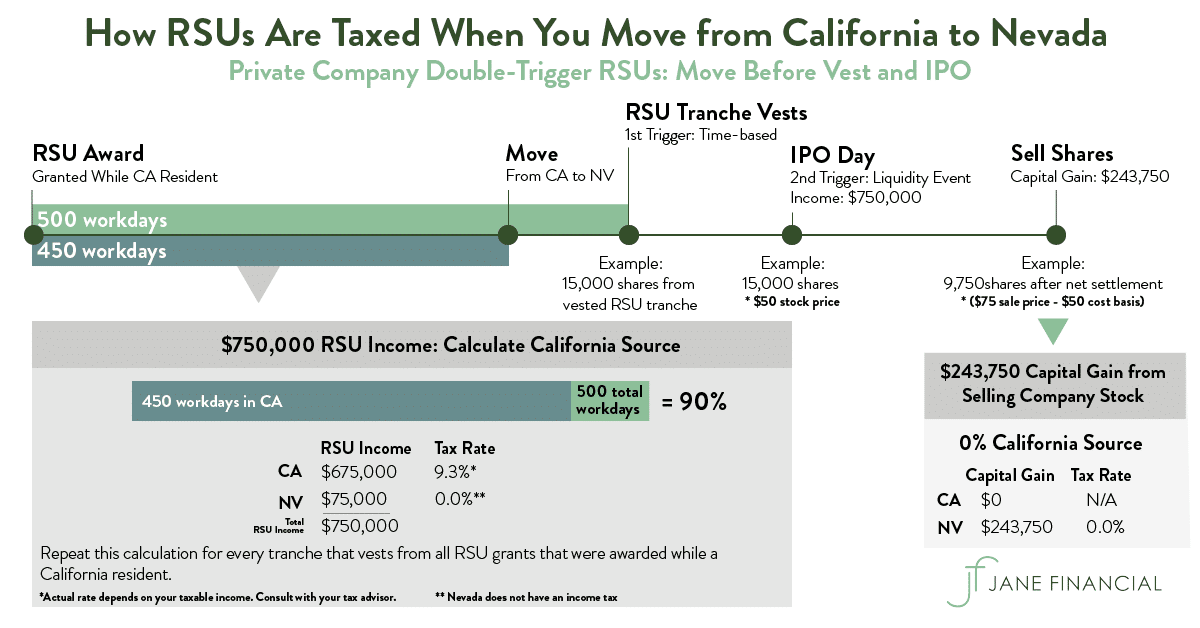

Restricted Stock Units Jane Financial

Restricted Stock Units Rsus Facts

How Restricted Stock And Rsus Are Taxed Cryptostec

Restricted Stock Units Rsus Merriman

When Do I Owe Taxes On Rsus Equity Ftw

Restricted Stock Units Jane Financial

Rsus A Tech Employee S Guide To Restricted Stock Units

Restricted Stock Units Jane Financial

Restricted Stock Units Or Rsu S Explained Wiser Wealth Management

Restricted Stock Unit Taxes Your W 2 Everything Else You Should Know Tl Dr Accounting

Restricted Stock Units Jane Financial