alameda county property tax rate

California citizens can get this 10000 homestead exemption together with the 25000 one that is available to all homeowners. Can however rise and fall with the wind.

Decline In Market Value Alameda County Assessor

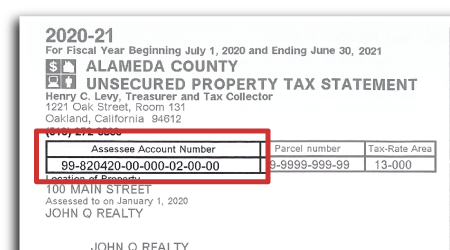

Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612.

. It has been brought to the Countys attention that certain organizations are offering to obtain uncontested tax refunds from the County on taxpayers behalf for a large fee. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Alameda County Tax Appraisers office. Show Prior Year Tax History for Parcel Number.

However the costs dont stop here as some cities in Alameda. Alameda County Property Taxes Payment With E-check. Click to see full answer Besides what is the tax rate in Alameda County.

2 How to make the Alameda County Property Tax Payment Online. For more details look up properties directly by address for a quick tax overview. The median property tax on a 59090000 house is 401812 in Alameda County.

Select the option to start invoice payments. Overview of Alameda County CA Taxes The average effective property tax rate in Alameda County is 078. The tax type should appear in the upper left corner of your bill.

The State of California property tax year is July 1st through June 30th. The tax type should appear in the upper left corner of your bill. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

You can pay online by credit card or by electronic check from your checking or savings account. In this state you are also entitled to school parcel tax exemption. So if you purchase a house that costs 600000 you are required to pay 600 in county transfer taxes.

20 rows Residents of Alameda County where the median home value is 707800 pay an average effective. No fee for an electronic check from your checking or savings account. Pay Your Property Taxes Online.

Property Tax Rates and Refunds Learn more about our supported browsers ADVISORY. This is the total of state and county sales tax rates. 7 rows Search Secured Supplemental and Prior Year Delinquent Property Taxes.

Secured tax bills are payable online from 1062021 to 6302022. Advanced searches left. Note that both current and prior year bills will be displayed after searching by a parcel number.

It is estimated that California residents pay an average of zero in property taxes. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the official business of Alameda County. The average effective property tax rate in Alameda County is 079.

Make checks payable to. How much is property tax in Bay Area. View Property Ownership Information property sales history liens taxes zoningfor 3116 El Portal Alameda CA 94502 - All property data in one place.

Home Blog Pro Plans Scholar Login. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612. California Property Tax Senior ExemptionSchool District Taxes.

The median property tax on a 59090000 house is 437266 in California. This is an advisory that if you have such a refund owed to you due to overpayment of property taxes or an. Alameda County Property Taxes.

Prior Year Delinquent tax payments are payable online to 6302022. For payments made online a convenience fee of 25 will be charged for a credit card transaction. Quickly see tax rates in your area including other properties tax amount per square foot by interacting with the map below.

How Alameda County property taxes are determined Alameda County comprises 14 different cities with some of the most desirable suburban properties in Californias Bay Area. In Alameda County homeowners end up paying an average of 3993 per year in property taxes. You can qualify for a homestead exemption for school district taxes if you are.

The California state sales tax rate is currently 6. The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose. Alameda County Property Taxes Payment With Credit Card.

You pay up to 11 in county taxes depending on where you live. The county tax rate is the same across the state of California. For example property taxes due for the fiscal year July 1 2014 through June 30 2015 are assessed on January 1 2014.

The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of 068 of property value. The minimum combined 2020 sales tax rate for Alameda County California is 925. View Alameda County Property Tax Bills.

They are 65 and 1 respectively. Businesses are required by law to file an annual Business Property Statement BPS if their aggregate cost of business personal property is 100000 or greater or if the Assessor requests the information in writing. Taxes on property that are not a lien against real property sufficient in the assessor opinion to secure payment of taxes.

This means that every county including Alameda has a rate of 110 per 1000 of the assessed property value. No fee for an electronic check from your checking or savings account. Collected from the entire web and summarized to include only the most important parts of it.

The system may be. Most supplemental tax bills are payable online to 6302022. When researching payments for federal income tax purposes you may need to look at two different.

Taxes on unsecured property tax the assessments on personal property such. Look Up Your Property Taxes. We accept Visa MasterCard Discover and American Express.

Bill of Alameda County Property Tax. A convenience fee of 25 will be charged for a credit card transaction. Select from one of the tax types below to research a payment.

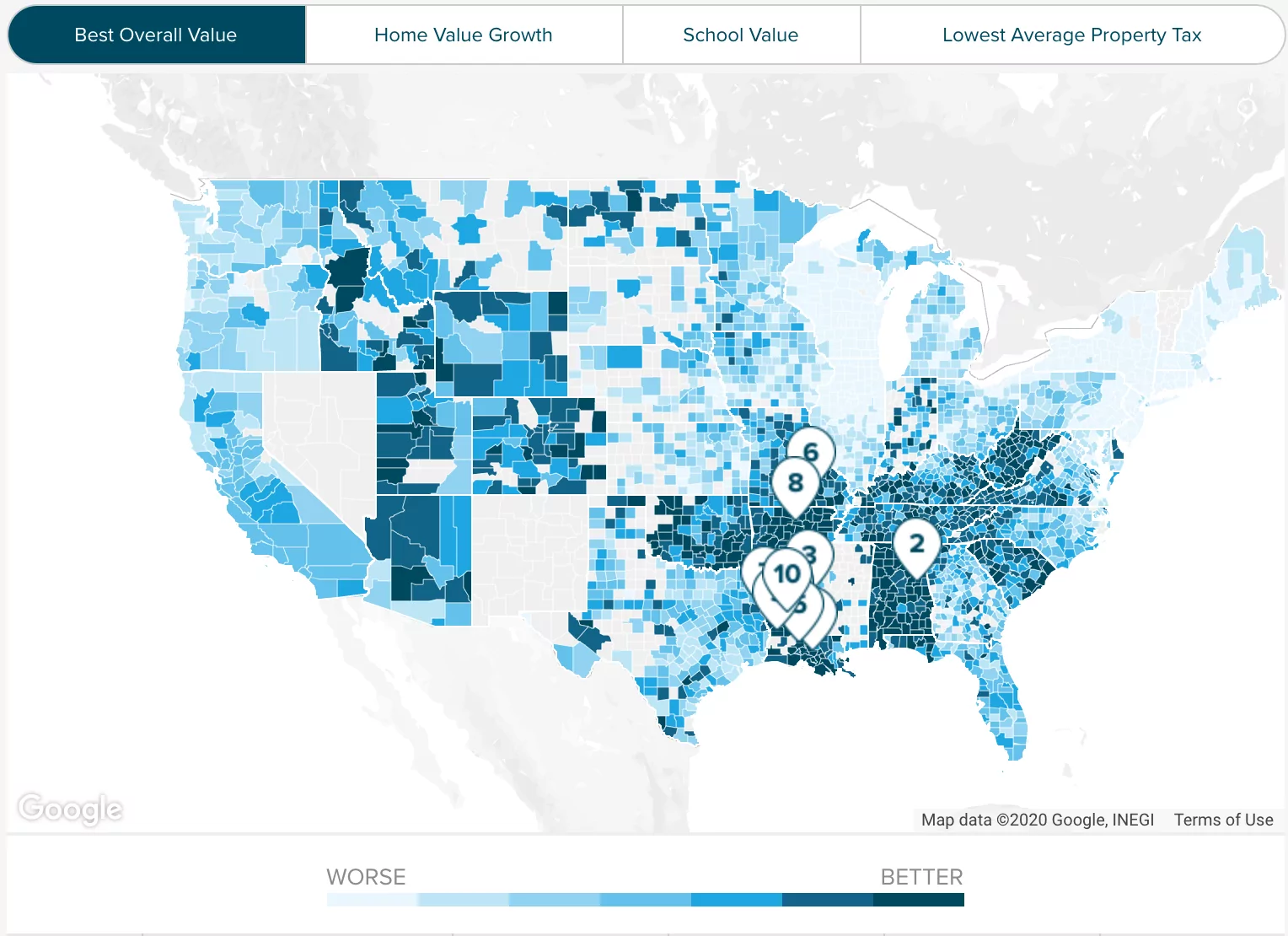

Can be used as content for research and analysis. For tax balances please choose one of the following tax types. Tax Rates for Alameda County The average percentage levied against properties is currently 0866 but Alameda County covers an extremely diverse area in terms of home price so your best bet is to look properties up by parcel value.

Filing Form 571L Business Property Statement. The Property Tax Rate for the City and County of San Francisco is currently set at 11801 of the assessed value for 2019-20. Alameda County 04648 California 04515 National 03601 Researching Tax Rates in a Specific Area.

In California the average home price is about 588000 which is one reason the annual property taxes are high. Who do I make my check payable to.

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Ownership Interests Fee Simple Improve Condominium

Transfer Taxes Clerk Recorder S Office Alameda County Alameda County Alameda Clerks

Itunes Version Of Our Alameda County Property App You Can Lookup Your Property Taxes Property Assessment And Parcel Maps You Alameda County Alameda Property

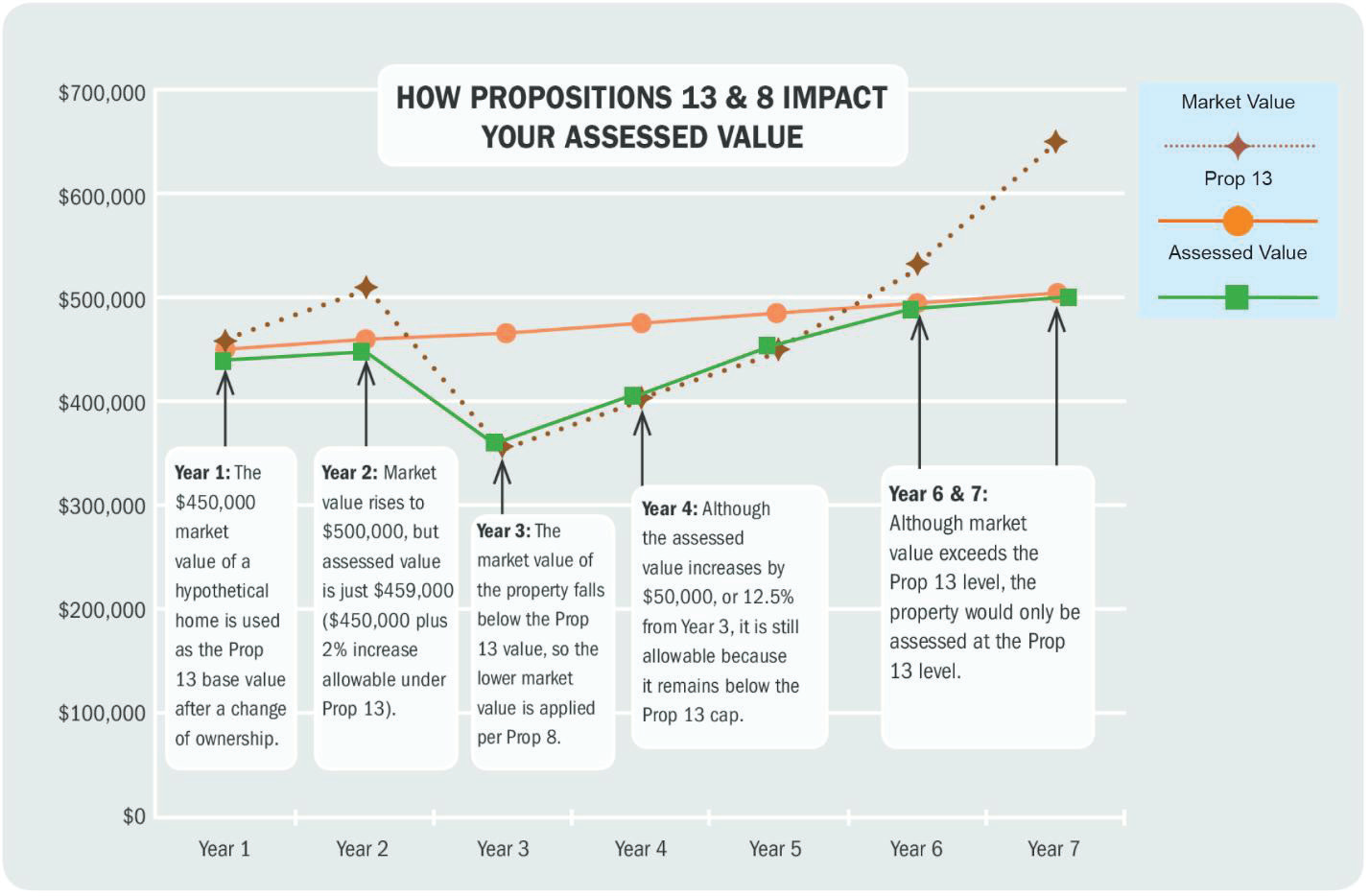

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Prop 19 Ahead Would Change Residential Property Tax Transfer

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Search Unsecured Property Taxes

Alameda County Ca Property Tax Search And Records Propertyshark

Understanding California S Property Taxes

Alameda County Ca Property Tax Search And Records Propertyshark

Alameda County Ca Property Tax Calculator Smartasset

Looters Hit Stores In Emeryville Richmond San Lorenzo Police Say Same Group Targeted Oakland Night Before Home Realestate San Lorenzo Richmond Emeryville

Alameda County Ca Property Tax Calculator Smartasset

Pin On Articles On Politics Religion

Alameda County Ca Property Tax Search And Records Propertyshark

Homeownership Has Its Benefits Home Ownership Real Estate Infographic Real Estate